In one of the most significant cybercrime crackdowns in modern history, the U.S. Department of Justice (DOJ) has seized nearly $15 billion worth of Bitcoin linked to an extensive international fraud operation. The scheme, allegedly directed by Chen “Vincent” Zhi, the CEO of Cambodia’s Prince Holding Group, represents the largest cryptocurrency forfeiture ever carried out by the department.

However, this case is far more than a financial milestone. It sheds light on a dark underworld of scams combining human trafficking, emotional manipulation, and digital deceit. The operation revealed the disturbing scale of what’s known as the “Pig Butchering” scam a sophisticated form of fraud that preys on human trust and loneliness to drain victims’ savings worldwide.

What Is the “Pig Butchering” Scam?

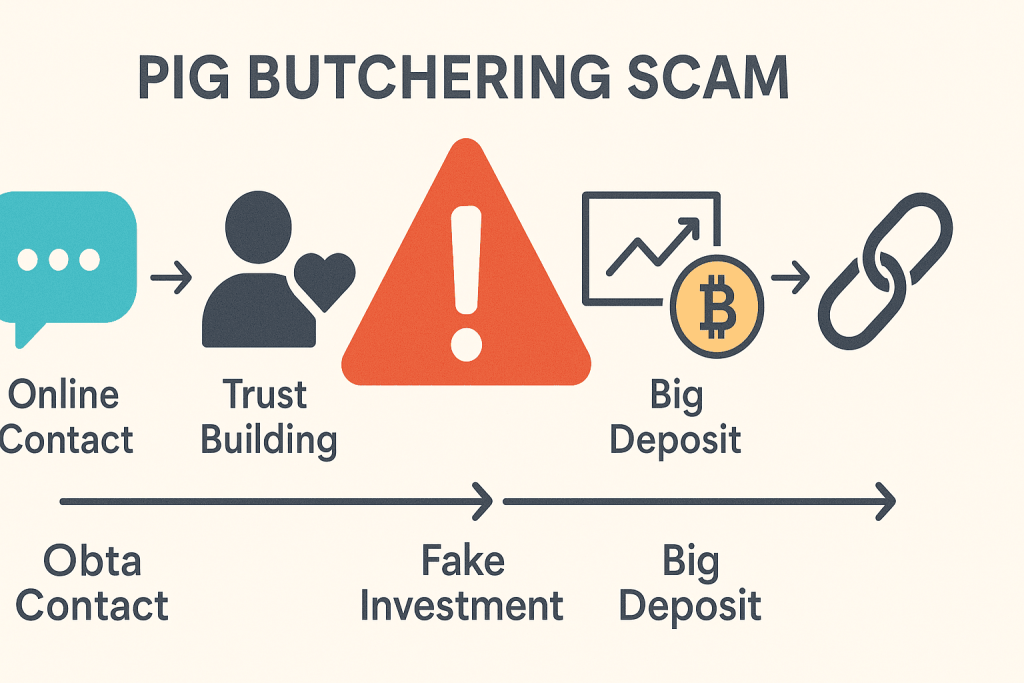

The phrase “pig butchering” refers to the method scammers use on their victims. Much like fattening a pig before slaughter, fraudsters spend weeks or even months developing emotional connections with their targets before ultimately convincing them to invest large sums of money into fake cryptocurrency or investment platforms.

These scams typically start with an innocent approach a message from a supposed wrong number, a friendly introduction on social media, or a match on a dating app. The scammer appears patient, charming, and genuine, carefully building a relationship. Once trust is secured, they introduce a so-called “profitable investment opportunity,” often supported by fabricated charts, testimonials, and websites designed to look legitimate.

Victims, convinced by the bond and the illusion of authenticity, begin to invest. Initially, they might see fake “profits” displayed on the fraudulent platform, reinforcing their confidence. But when they attempt to withdraw their funds, they discover that the money and the scammer has disappeared.

The Prince Holding Group Connection

Investigators claim that Prince Holding Group, a large conglomerate with extensive business operations across Cambodia and Southeast Asia, was secretly running cyberfraud compounds under the guise of legitimate enterprises.

According to U.S. prosecutors, CEO Chen “Vincent” Zhi and his associates used trafficked labor workers deceived by false job promises to execute romance and investment scams aimed at victims in the West.

These exploited workers were forced to manage fake profiles, initiate conversations online, and build emotional relationships with unsuspecting victims before manipulating them into transferring cryptocurrency to sham investment accounts controlled by the syndicate.

The U.S. Department of Justice and the U.K. government have imposed strict economic sanctions on Prince Holding Group and its subsidiaries, labeling the organization a “transnational criminal enterprise.” Zhi, who remains a fugitive, faces multiple charges, including wire fraud and money laundering, filed in a New York federal court.

The Scale of the Scam

The scope of the fraud is staggering. According to the U.S. Treasury Department, Americans alone lost over $10 billion to scams originating from Southeast Asia in 2024. This marks a 210% surge in deposits and a 40% increase in total scam revenue compared to 2023.

The crimes are not confined to the United States victims span across Europe, the United Kingdom, Canada, and Australia, showing just how organized and widespread these operations are. In most cases, the victims never recover their funds, as scammers swiftly convert stolen cryptocurrency into untraceable privacy coins or launder it through complex blockchain transactions that make recovery nearly impossible.

How “Pig Butchering” Scams Work

Understanding how these scams unfold is essential to identifying warning signs early.

- The Hook

Scammers initiate contact casually, often through a text message, social media, or a dating app. They start friendly and engaging, never raising immediate suspicion. - The Bond

Over time, they build trust sharing daily conversations, emotional stories, and even fabricated personal struggles. The victim feels a growing emotional connection. - The Lure

Once trust is established, the scammer introduces the idea of a “smart investment.” They may show screenshots of alleged profits or direct the victim to a convincing but fake trading platform. - The Investment

Victims invest small amounts at first and are shown fake returns. Encouraged by these false gains, they invest more. Scammers manipulate the dashboards to simulate profits. - The Butchering

When the victim attempts to withdraw funds or stops investing, access is blocked, and the scammer vanishes. The emotional and financial impact is devastating.

Why These Scams Succeed

- Emotional Exploitation

Scammers use psychology as a weapon. They mirror the victim’s interests, build empathy, and exploit emotions like loneliness and hope. - Advanced Technology

The fake trading sites and mobile apps often look identical to legitimate platforms, complete with realistic charts, dashboards, and even customer service options. - Social Engineering Tactics

These criminals understand human behavior deeply, leveraging greed, trust, and curiosity to lower the victim’s guard. - Victim Silence

Many victims feel ashamed and avoid reporting the crime, allowing these networks to continue operating largely undetected.

The Human Trafficking Component

One of the most horrifying aspects of this criminal network is the use of human trafficking to power the scams. Many individuals behind the fake profiles are victims themselves, trapped in abusive working conditions.

Reports show that young people from countries such as Myanmar, Vietnam, and the Philippines are deceived with promises of legitimate, high-paying tech jobs. Once they arrive in countries like Cambodia or Laos, their passports are confiscated, and they are forced to work in scam compounds under harsh conditions sometimes for up to 16 hours a day.

This form of exploitation turns cybercrime into modern-day slavery, with victims on both sides of the scam suffering unimaginable harm.

How to Protect Yourself from Pig Butchering Scams

- Be cautious with sudden online friendships. If someone you barely know begins discussing investments, treat it as a red flag.

- Avoid investing through personal connections. Legitimate investors do not solicit private transfers or use unverified apps.

- Research before investing. Verify any investment platform’s authenticity and stick to regulated financial institutions.

- Beware of “guaranteed” profits. No genuine investment is risk-free or promises instant returns.

- Report suspicious behavior. Victims should immediately contact the FBI’s Internet Crime Complaint Center (IC3) or local law enforcement. Quick reporting improves the chances of tracing stolen assets.

A Global Wake-Up Call

The DOJ’s $15 billion Bitcoin seizure is more than a legal victory it’s a crucial warning to the world. The case uncovers how deeply intertwined romance scams, human trafficking, and cryptocurrency fraud have become, forming an organized global network.

As technology continues to advance, so too do the tactics of online scammers. Staying informed, vigilant, and educated remains our best defense.

Trusted & True is dedicated to raising awareness about online fraud, digital safety, and cybersecurity, helping readers protect themselves and their loved ones in an increasingly digital world.